Optimizing Your Home Buying Prospective: An Extensive Consider Jumbo Car Loan Funding Options

Browsing the intricacies of jumbo funding financing can considerably enhance your home acquiring possible, particularly for high-value residential properties that exceed conventional funding limits. Understanding the eligibility requirements, including the necessity for a durable credit report and significant deposit, is essential for prospective customers (jumbo loan). In addition, the competitive landscape of rate of interest and associated charges tests both presents and chances. As you think about these aspects, the question stays: how can you purposefully position yourself to make the most of these funding options while lessening threats?

Comprehending Jumbo Car Loans

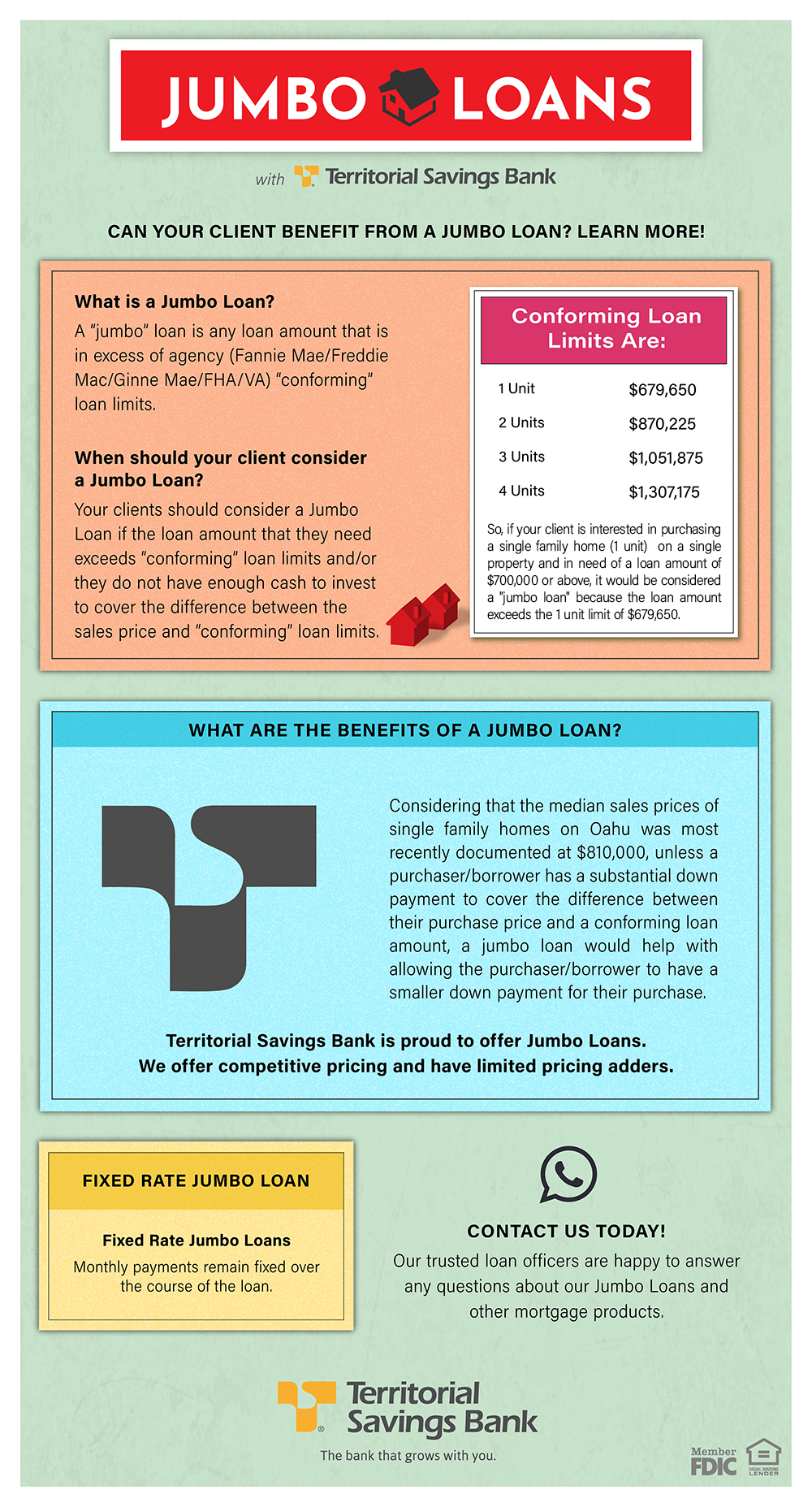

In the world of mortgage funding, jumbo lendings work as a crucial option for borrowers seeking to buy high-value buildings that go beyond the adhering lending limitations established by government-sponsored business. Generally, these limitations differ by area and are figured out each year, commonly showing the neighborhood housing market's dynamics. Big financings are not backed by Fannie Mae or Freddie Mac, which distinguishes them from traditional lendings and introduces different underwriting criteria.

These financings usually include greater rate of interest as a result of the regarded danger related to larger finance quantities. Debtors that go with big funding generally call for an extra extensive economic account, consisting of higher credit history scores and lower debt-to-income ratios. In addition, jumbo loans can be structured as adjustable-rate or fixed-rate mortgages, enabling borrowers to select a payment strategy that lines up with their financial goals.

The importance of big lendings prolongs past simple financing; they play a critical function in the high-end realty market, allowing buyers to acquire residential properties that stand for considerable investments. As the landscape of mortgage options progresses, recognizing jumbo fundings comes to be necessary for browsing the complexities of high-value home acquisitions.

Qualification Needs

To receive a big car loan, borrowers have to meet details eligibility needs that differ from those of conventional financing. Among the key criteria is a higher credit history rating, commonly calling for a minimum of 700. Lenders assess credit reliability carefully, as the raised car loan quantities entail greater danger.

In addition, jumbo funding applicants usually need to offer evidence of considerable income. Lots of lending institutions favor a debt-to-income proportion (DTI) of 43% or lower, although some may enable approximately 50% under particular conditions. This makes sure debtors can handle their month-to-month settlements without monetary stress.

Moreover, considerable possessions or reserves are frequently needed. Lenders may request for a minimum of 6 months' well worth of home loan settlements in liquid possessions, showing the borrower's ability to cover costs in instance of revenue interruption.

Last but not least, a bigger down repayment is normal for big financings, with many lending institutions expecting at least 20% of the acquisition cost. This need reduces danger for loan providers and shows the customer's commitment to the investment. Fulfilling these stringent eligibility requirements is vital for protecting a big loan and successfully browsing the premium realty market.

Rates Of Interest and Costs

Recognizing the details of interest rates and fees connected with jumbo fundings is important for possible customers. Unlike adhering finances, big car loans, which exceed the adhering funding restrictions established by Fannie Mae and Freddie Mac, normally featured greater interest prices. This increase is attributable to the regarded risk loan providers tackle in moneying these larger financings, as they are not backed by government-sponsored business.

Rates of interest can differ significantly based on a number of factors, consisting of the borrower's credit rating score, the loan-to-value ratio, and market problems. It is important for customers to go shopping around, as different loan providers might supply varying terms and prices. Additionally, jumbo fundings might include higher charges, such as source costs, appraisal costs, and personal mortgage insurance (PMI) if the down payment is much less than 20%.

To lessen expenses, debtors should very carefully review the charge structures of various lending institutions, as some might offer reduced rate of interest however higher costs, while others may offer an extra well balanced approach. Ultimately, understanding these elements aids consumers make informed choices and enhance their funding options when acquiring high-end properties.

Benefits of Jumbo Financings

Jumbo lendings offer substantial benefits for buyers seeking to acquire high-value residential properties. Among browse this site the main advantages is that they give access to funding that goes beyond the conforming finance restrictions established by the Federal Housing Money Company (FHFA) This permits customers to safeguard larger financing amounts, making it possible to obtain glamorous homes or residential or commercial properties in very popular areas.

In addition, big finances frequently feature affordable rate of interest, especially for borrowers with strong credit report profiles. This can result in significant financial savings over the life of the financing. Additionally, big car loans generally enable a range of loan terms and structures, providing adaptability to tailor the financing to fit private monetary scenarios and long-term goals.

One more secret advantage is the possibility for lower down payment needs, depending upon the lending institution and consumer qualifications. This allows buyers to go into the premium actual estate market without needing to dedicate a considerable ahead of time resources.

Finally, jumbo finances can provide the opportunity for greater cash-out refinances, which can be valuable for home owners aiming to use their equity for major expenditures or various other financial investments - jumbo loan. Generally, jumbo lendings can be an efficient device for those navigating the top echelons of the housing market

Tips for Protecting Funding

Safeguarding funding for a jumbo finance requires cautious prep work and a critical strategy, specifically given the one-of-a-kind qualities of these high-value home mortgages. Begin by examining your monetary health and wellness; a durable credit rating score, normally over 700, is crucial. Lenders sight this as a sign of reliability, which is important for jumbo fundings straight from the source that surpass adjusting financing limits.

Involving with a home loan broker experienced in big car loans can supply valuable understandings and access to a larger variety of financing choices. By adhering to these pointers, you can improve your opportunities of efficiently safeguarding funding for your jumbo car loan.

Conclusion

To conclude, big financings provide distinct benefits for purchasers seeking high-value residential or commercial properties, provided they fulfill details qualification requirements. With requirements such as a strong credit history rating, low debt-to-income ratio, and substantial deposits, potential property owners can access deluxe realty possibilities. By comparing rate of interest and teaming up with skilled mortgage brokers, people can enhance their home getting potential and make educated financial decisions in the competitive property market.

Browsing the intricacies of big lending funding can substantially improve your home getting prospective, specifically for high-value buildings that exceed standard finance limits.In the world of mortgage financing, jumbo finances serve as an important option for debtors looking for to purchase high-value residential or commercial properties that go beyond the adhering financing restrictions set by government-sponsored business. Unlike adhering loans, jumbo fundings, which go beyond the adapting car loan limitations set by Fannie Mae and Freddie Mac, typically come with higher rate of interest prices. Big financings generally permit for a range of funding terms and more info here frameworks, providing versatility to customize the financing to fit specific long-term goals and monetary scenarios.

Lenders sight this as an indication of integrity, which is crucial for jumbo fundings that go beyond adjusting loan limits. (jumbo loan)